Once we have contextualized the problem of determining what a company is worth, we can explain in more detail the methodologies. But, before going to it, we would like to point out one important question that is the difference between company value and equity value. This is a simple question but very important. Equity value is the net value of what owners have in a company; this means the value of the company minus what the company owes others apart from owners. So that, we calculate the value of the company and deduct company debts to obtain the equity value. Easy, but important to bear in mind.

Let us go to explain the qualitative methodologies.

Scorecard

The Scorecard Valuation methodology was fully developed by Bill Payne, the Angel Capital Association’s 2009 US Angel Investor of the Year, with full details presented in his book, The Definitive Guide to Raising Money from Angels. This method is also named as Benchmark Method.

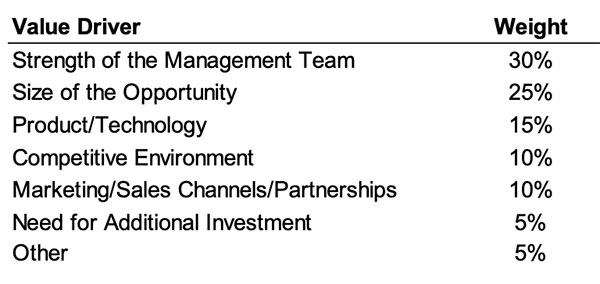

The Scorecard Methodology takes the average industry pre-money valuation and introduces individual weighted percentages based on a detailed number of quantitative and qualitative factors per categories, which assist to encompass the nitty-gritty worth of the startup at inception. The method then assigns comparison factors to the percentage weights to refer to the company we are valuing. These comparison factors may be 0 or even more than 100% if the company is stronger in that factor than the comparable sector. Multiplying the sum of the factors, we get an overall multiplier to apply to the average industry pre-money valuation to get our own company pre-money valuation. The following table represents the factors, or value drivers, and their weights:

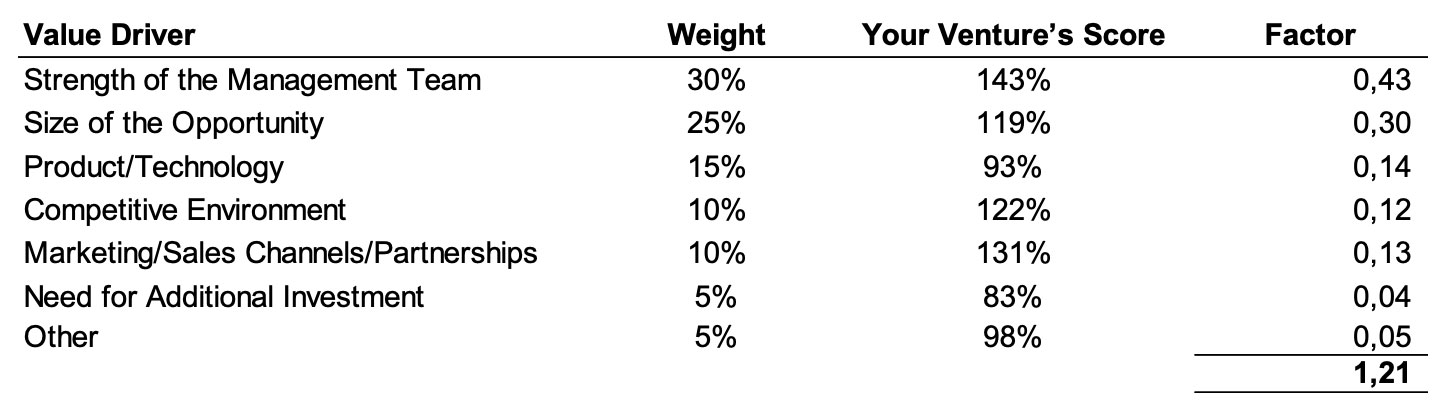

The following table shows, as an example, how the company has considered its competitive strength or performance compared to sector and per value driver, to get a factor per concept and a total one:

Simple, isn’t it? This company is 1,21 more valuable than the average market valuation of companies like this one. The reasoning behind is, there is a market average value that recognizes the average behavior of companies of this type from an investor point of view and this specific one is stronger than the average, or saying in a different manner, this company has lower risks than average, so it has a higher value than market average, 1,21 times higher value.

Berkus

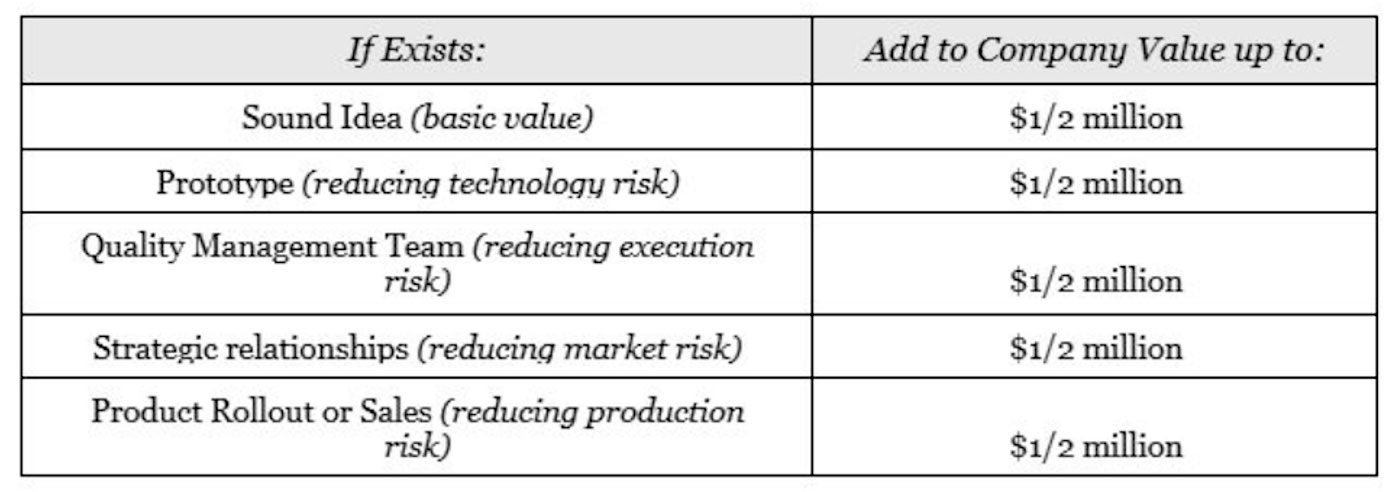

Note that these numbers are maximums that can be “earned” to form a valuation, allowing for a pre-revenue valuation of up to 2,5MUSD.

As you have realized, this method is quite similar to the Scorecard one.

Risk factor summation

The Risk Factor Summation method (RFS-method) uses a base-value of a comparable startup for the valuation of the target company, this is the same pre-revenue average industry pre-money valuation referred in the Scorecard method. This base-value is then adjusted for 12 standard risk factors. This means you compare your startup to other startups and assess whether you have higher or lower risk. The following are the 12 risk factors considered:

- Management

- Stage of the business

- Legislation/Political risk

- Manufacturing risk

- Sales and marketing risk

- Funding/capital raising risk

- Competition risk

- Technology risk

- Litigation risk

- International risk

- Reputation risk

- Potential lucrative exit

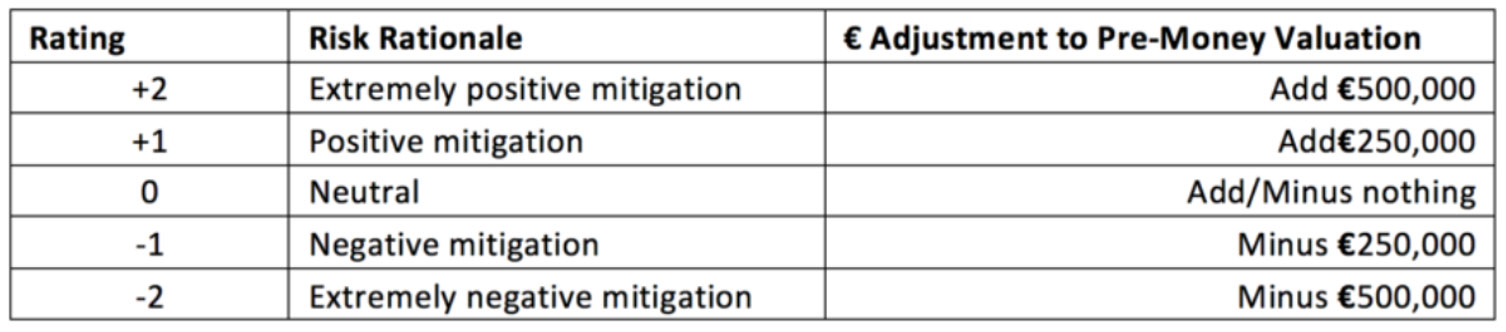

Instead of assigning percentage weights and multiples, this method assigns ratings to each risk factor and do an adjustment to the average pre-money valuation per each rating: