Against what is commonly considered, determining what a company is worth, is not mathematics. There are many different methods, but they do not apply to all companies because they were designed for specific stages of maturity of companies. But, moreover, the valuation of a company is many times dependent on market segment specific trends, what type of investors you are seeking, why you pretend to sell the company or what you pretend to do the day after the transaction.

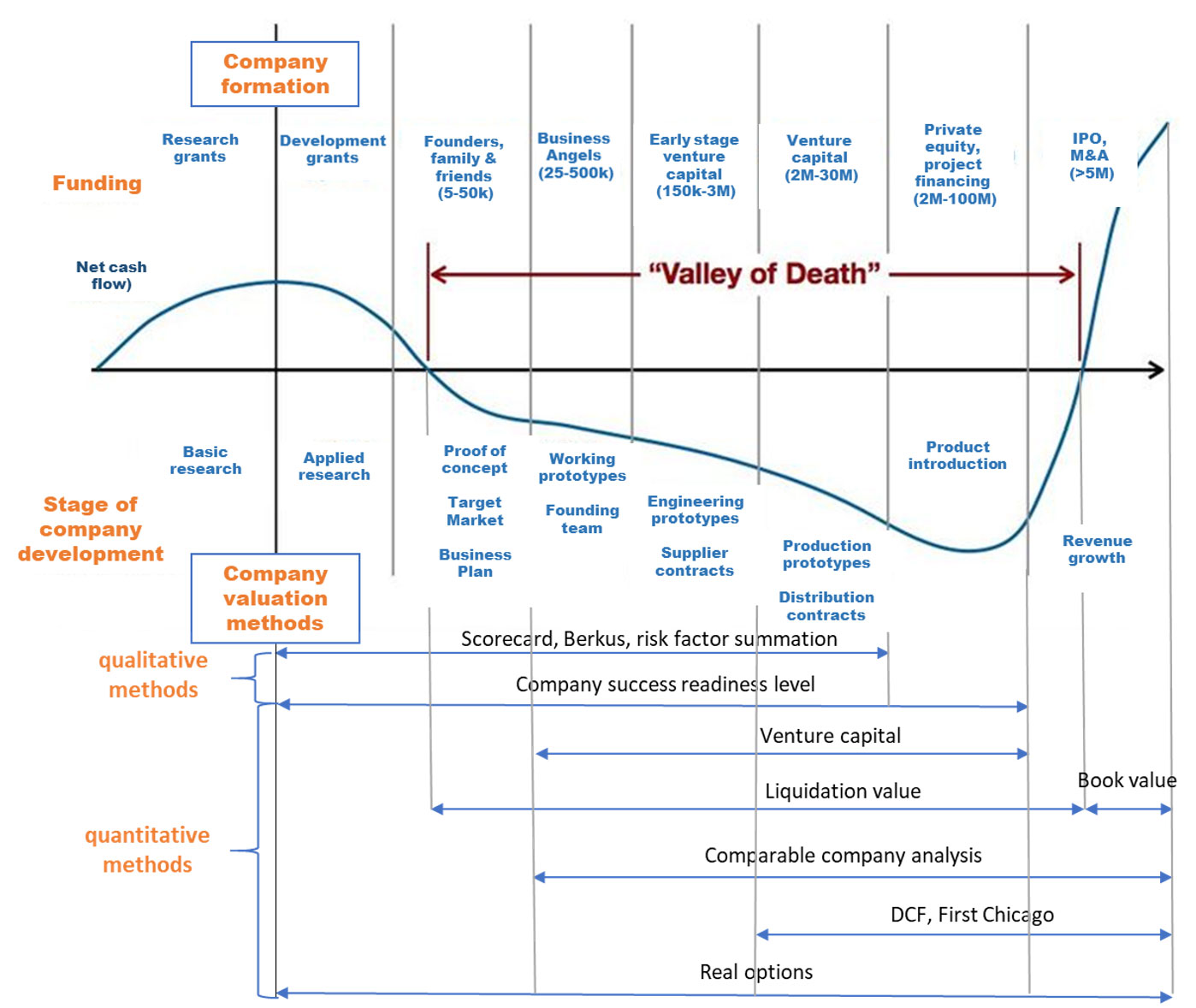

For start-ups, in pre-revenue phases or with revenues but still defining their income models, the valuation cannot be based on historical figures to predict the future but on the idea, the team, the market and other qualitative variables.

For more mature businesses, financial figures, will likely be used to determine a valuation by means of different quantitative methods. But the valuation of a mature company to determine the price in a transaction may also be significantly different depending on the purpose of the transaction and the situation of both parties, sellers and buyers, or the current trend of a specific market segment where the company operates.

It is understandable that the value of a company is not the same when the company is an on-going business with good expectations than a company of the same sector that is facing a liquidation process. In the first case, we would like to know the business plan to understand the forecasts in terms of profit and losses, investments, and cash flows. In the second one, we would like to have a deep understanding of assets and liabilities and their market value.

So that, there is neither a unique value for a company, nor a single methodology to calculate it but a bunch of methodologies and values that provide the parties tools to support their negotiations.

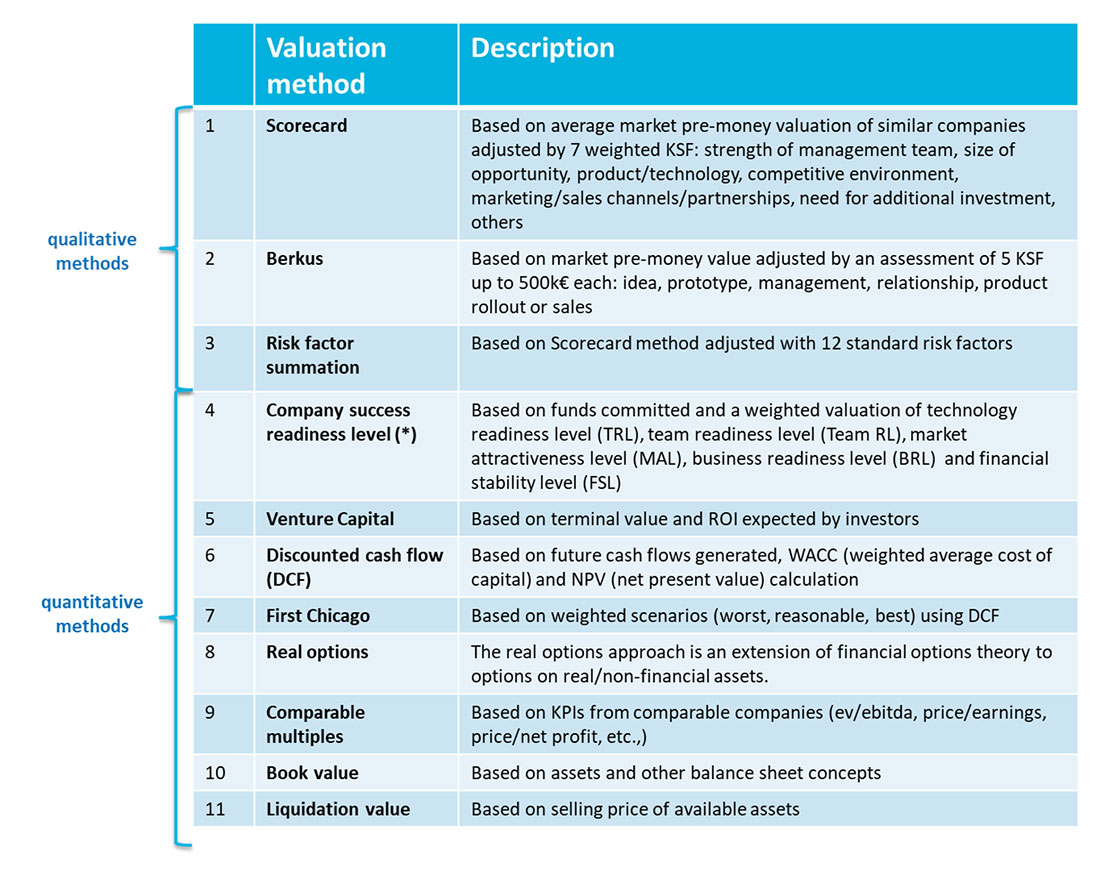

In general terms, from the nature of their calculation approaches, we may say that there are two groups of methodologies to valuate a company: qualitative and quantitative methodologies.

Qualitative methods

Quantitative methods

Quantitative methods are based on financial magnitudes. Since start-ups do not have historic financial figures to be considered because they may not have yet revenues or positive EBITDA, EBIT or EAT, these methods have many limitations for these companies and can provide erratic values. On the other hand, these methods are very useful to determine valuations for SMEs with financial track record.

There are many quantitative methods such as: Venture Capital, Discounted Cash Flow (DCF), First Chicago, Real Options, Book Value, Liquidation Value or Multiples of Market Comparable Companies.

During this blog we will include descriptive details of all methods, but to gain initial visibility, the following table summarizes referred methodologies

Company Valuation Methods

(*) Proprietary methodology developed by GRECA

DCF: Discounted Cash Flow

KPIs: Key Performance Indicators

KSF: Key Success Factors

NPV: Net Present Value

ROI: Return On Investment

WACC: Weighted Average Cost of Capital

As you can see, there are different applicable methods to each company stage. So, it would be fair from you to ask for the most accurate or precise or useful or employed method. The answer to that question would be “it depends”. But we could give a relevant clue to understand this apparent mesh. Please, pay attention. A company is an asset, a specific one, but an asset. The value of any asset is the money we will get from it. Maybe, we need to invest in the short term to get money back. In this case we talk about cash flows, negative and positive. If we get more money than what we put, this asset is a profitable one, if we pay more for this asset than what we are expecting to receive, this is a bad deal. But, even more, the sooner an investor receives the money back the better. An investment in a company that provides positive cash flows in the short term is more profitable than investing in a company that generates the same cash flows but in a longer period. And just to finish, there is one additional factor that is the “risk”. The riskier or unpredictable a business is the higher profitability an investor will ask. This means that an investor will value higher a business without risks than a business with different risks, being them related to market, legislation, technology, team or whatsoever. Any company valuation method is translating these previous considerations into a simplified or more complex methodology. Summarizing, how much money an investor could expect to get and what is the level of risk to assume to get the forecasted cash flows are the key elements to establish a value of a company.